Cryptocurrency feels confusing when you first hear about it. Bitcoin, Ethereum, wallets, exchanges, volatility — it can sound like a foreign language. Many beginners hesitate because they don’t want to lose money or make costly mistakes.

This guide on cryptocurrency investing for dummies breaks everything down in simple terms. You’ll learn what crypto is, how to invest safely, how to manage risk, and how to estimate potential returns before putting your money on the line.

No hype. No promises of overnight wealth. Just clear, practical education to help you make informed decisions.

Table of Contents

What Is Cryptocurrency?

Cryptocurrency is digital money that exists only online. Unlike traditional money issued by governments, crypto operates on decentralized networks powered by blockchain technology.

The most popular cryptocurrency is Bitcoin, launched in 2009. Since then, thousands of other cryptocurrencies have been created.

Here’s the simplest way to think about it:

- Regular money = controlled by banks and governments

- Cryptocurrency = controlled by code and distributed networks

Crypto can be used for:

- Sending money globally

- Investing for long-term growth

- Participating in blockchain-based applications

For live price data and market capitalization, platforms like CoinMarketCap provide reliable market tracking tools.

What Is Blockchain? (The Technology Behind Crypto)

Blockchain is the foundation of cryptocurrency. It’s a digital ledger that records transactions across thousands of computers worldwide.

Imagine a shared Google Sheet that everyone can see, but no single person controls. Once data is added, it cannot easily be changed. That’s blockchain.

Key features:

- Transparent

- Secure

- Decentralized

- Tamper-resistant

This system removes the need for traditional intermediaries like banks. That’s one reason crypto investing basics often start with understanding blockchain first.

Why Do People Invest in Cryptocurrency?

There are three main reasons beginners enter the crypto market:

1. Growth Potential

Bitcoin and Ethereum have historically delivered strong long-term returns, although past performance does not guarantee future results.

2. Inflation Hedge

Some investors see Bitcoin as “digital gold” because of its limited supply (21 million coins).

3. Technology Innovation

Blockchain powers decentralized finance (DeFi), NFTs, and Web3 applications.

However, crypto market volatility explained in simple terms: prices move fast. Gains can be large — but so can losses.

Types of Cryptocurrencies Explained Clearly

Not all cryptocurrencies are the same. Here’s a breakdown:

| Type | Example | Purpose | Risk Level |

|---|---|---|---|

| Bitcoin | BTC | Store of value | Moderate |

| Ethereum | ETH | Smart contracts & apps | Moderate |

| Altcoins | SOL, ADA | Various projects | High |

| Stablecoins | USDT, USDC | Pegged to USD | Low |

Ethereum vs Bitcoin for Beginners

- Bitcoin: Digital gold, focused on value storage

- Ethereum: Platform for decentralized apps

Beginners often start with Bitcoin and Ethereum before exploring smaller altcoins.

Is Crypto Safe for Beginners?

Short answer: It depends on how you approach it.

Crypto itself is not a scam. However, risks include:

- Price volatility

- Regulatory changes (check updates from the SEC)

- Exchange hacks

- Scams and phishing

Safety comes from education and risk management in crypto investing.

Step-by-Step: How to Invest in Cryptocurrency for Beginners

Here’s your beginner roadmap.

Step 1: Choose a Reputable Exchange

Examples include:

- Coinbase

- Binance

- Kraken

Educational resources like Coinbase Learn help beginners understand how platforms work.

Step 2: Verify Your Account

Complete identity verification (KYC). This is required for security and compliance.

Step 3: Deposit Funds

Use bank transfer or debit card. Start small.

Step 4: Buy Your First Cryptocurrency

Most beginners start with:

- Bitcoin

- Ethereum

Avoid investing in unknown coins without research.

Step 5: Store Your Crypto Safely

Two options:

- Exchange wallet (convenient but less secure)

- Hardware wallet (more secure for long-term storage)

Long-Term vs Short-Term Crypto Investing

Long-Term Crypto Investment Strategy

- Buy and hold for years

- Focus on strong projects

- Ignore daily price swings

This approach reduces stress and emotional trading.

Short-Term Trading

- Active buying and selling

- Higher risk

- Requires experience

For beginners, long-term strategies are generally safer.

Crypto Portfolio Allocation for Beginners

Never invest everything into one asset.

Example beginner allocation:

- 50% Bitcoin

- 30% Ethereum

- 10% Large altcoins

- 10% Stablecoins

This diversification reduces risk if one asset underperforms.

Dollar Cost Averaging (DCA) Explained

Dollar cost averaging crypto means investing a fixed amount regularly, regardless of price.

Example:

- $500 every month

- Buy BTC or ETH

- Continue for years

Benefits:

- Reduces emotional investing

- Lowers timing risk

- Builds discipline

DCA is one of the most recommended strategies for cryptocurrency investing for dummies.

Crypto Market Volatility Explained

Crypto prices can move 10–20% in a single day.

Reasons include:

- Market sentiment

- News events

- Regulatory announcements

- Whale activity

Volatility creates opportunity but also risk. Beginners must avoid panic selling.

Risk Management in Crypto Investing

Smart investors protect capital first.

Follow these rules:

- Invest only what you can afford to lose

- Diversify

- Avoid leverage

- Secure private keys

- Research before buying

Never chase hype.

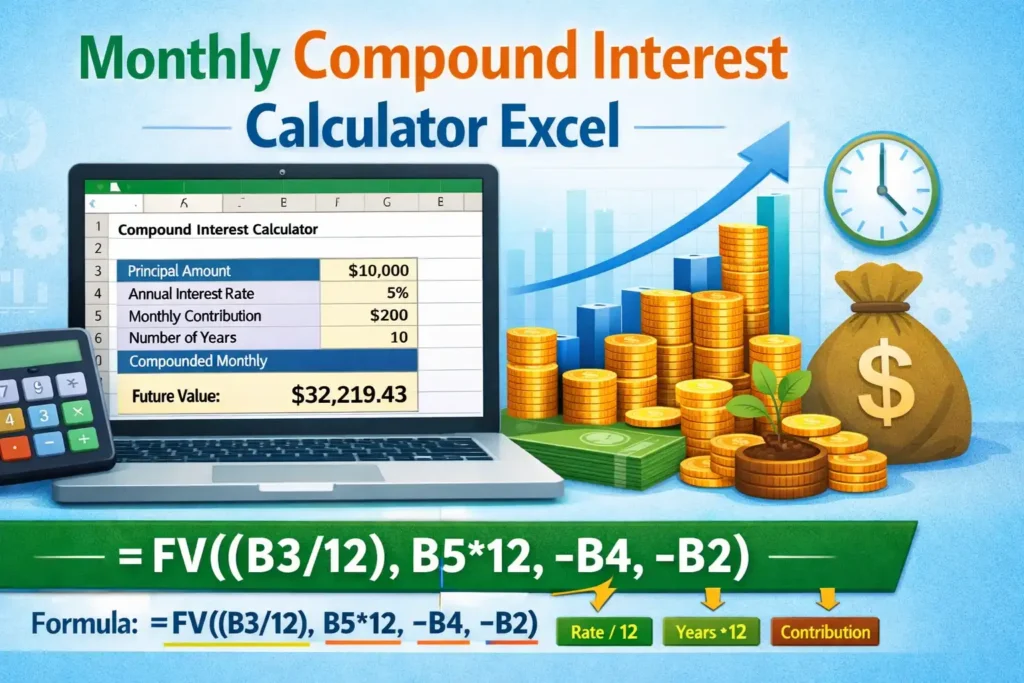

Practical Example: $500 Monthly Investment for 5 Years

Let’s calculate.

If you invest:

- $500 per month

- For 5 years

- Total invested: $30,000

Assume average annual growth of 15% (conservative compared to past crypto cycles).

After 5 years, your investment could grow to approximately $41,000–$45,000 depending on compounding and timing.

To estimate different scenarios before investing, beginners can use tools like this crypto profit calculator to model potential outcomes and understand risk exposure. Using such tools helps you make informed decisions instead of emotional ones.

How to Calculate Cryptocurrency Profit

Basic formula:

Profit = (Selling Price – Buying Price) × Quantity

Example:

- Bought 0.1 BTC at $30,000 = $3,000

- Sold at $40,000 = $4,000

- Profit = $1,000

Always consider:

- Exchange fees

- Taxes

- Withdrawal fees

Common Beginner Mistakes

Avoid these:

- Investing without research

- Buying only hype coins

- Panic selling during dips

- Ignoring security

- Using money needed for rent or bills

Crypto rewards patience, not impulsiveness.

FAQs

1. How do I start cryptocurrency investing for dummies as a complete beginner?

To begin cryptocurrency investing for dummies, first understand the basics of blockchain and how crypto markets work. Then choose a reliable exchange, complete verification, deposit funds, and start with well-known cryptocurrencies like Bitcoin or Ethereum. Beginners should focus on learning, diversification, and risk management instead of chasing quick profits.

2. Is cryptocurrency investing for dummies really suitable for beginners?

Yes, cryptocurrency investing for dummies is designed to help beginners understand crypto step by step. With proper education, disciplined strategies like dollar cost averaging, and controlled risk exposure, new investors can participate more confidently. The key is to start small, stay consistent, and avoid emotional decisions.

3. What is the safest approach in cryptocurrency investing for dummies?

The safest approach in cryptocurrency investing for dummies is to focus on established cryptocurrencies, diversify your portfolio, and avoid investing all funds in one asset. Long-term investing strategies combined with proper security practices reduce unnecessary risk.

4. Can beginners lose money in cryptocurrency investing for dummies?

Yes, beginners can lose money in cryptocurrency investing for dummies because crypto markets are highly volatile. Prices can move sharply due to market sentiment, regulations, or global events. That is why risk management, proper research, and long-term planning are essential.

5. Should I focus on Bitcoin or explore other coins in cryptocurrency investing for dummies?

In cryptocurrency investing for dummies, many beginners start with Bitcoin due to its strong market presence. Others also consider Ethereum because of its smart contract ecosystem. A balanced strategy often includes both, depending on your investment goals and risk tolerance.

6. How can I store assets safely in cryptocurrency investing for dummies?

For safe cryptocurrency investing for dummies, assets should be stored in secure wallets. Beginners may start with exchange wallets, but for long-term holdings, private wallets—especially hardware wallets—provide better protection against hacks and security risks.

7. What mistakes should I avoid in cryptocurrency investing for dummies?

Common mistakes in cryptocurrency investing for dummies include investing without research, following hype, panic selling during price drops, ignoring diversification, and neglecting security practices. Staying disciplined and informed is critical for long-term success.

Final Thoughts: Build Slowly, Invest Wisely

Cryptocurrency investing for dummies doesn’t have to be complicated. Start small. Focus on strong projects. Use dollar cost averaging. Diversify your crypto portfolio allocation. Manage risk. Most importantly, think long-term. Crypto is not a get-rich-quick scheme. It’s a high-risk, high-potential asset class that rewards patience and discipline. This content is for educational purposes only and not financial advice.